What Hidden Fees Exist in Crypto Networks and How to Minimize Them

Just like in traditional finance, cryptocurrency networks, platforms, exchanges, and other decentralized services also have various types of commission fees. Most of these networks and services claim that their fees are not only lower than those in similar centralized organizations but also completely transparent. While one can agree that fees in cryptocurrency operations are lower than in fiat finance, are some of them truly transparent?

Experience shows that users can encounter unexpected expenses. However, this is not always due to malicious actions by the cryptocurrency platform. Often, users themselves do not carefully study the policies of a cryptocurrency exchange, P2P platform, or ecosystem.

Studying and understanding hidden fees helps users effectively manage their funds.

We will examine various types of hidden fees in cryptocurrency networks and suggest effective methods for minimizing them.

Main Types of Hidden Fees in Crypto Networks

If you understand that services, exchanges, and platforms are created to make money, then the very concept of a hidden fee disappears for you. Potential expenses will only be a surprise during a transaction for an unprepared user.

Let's list the most common fees for the services of cryptocurrency decentralized platforms and services that can be a surprise if the user has not studied the platform's policy carefully enough. So, hidden expenses can be both types of commissions that the user did not expect and their size.

Service Fees

For most cryptocurrency operations on leading exchanges, only network fees apply. However, some wallets and exchanges charge additional fees for using their services, in addition to standard network fees. For example, the ZenGo wallet is known for its convenience but charges additional fees for its services.

High Transaction Fees

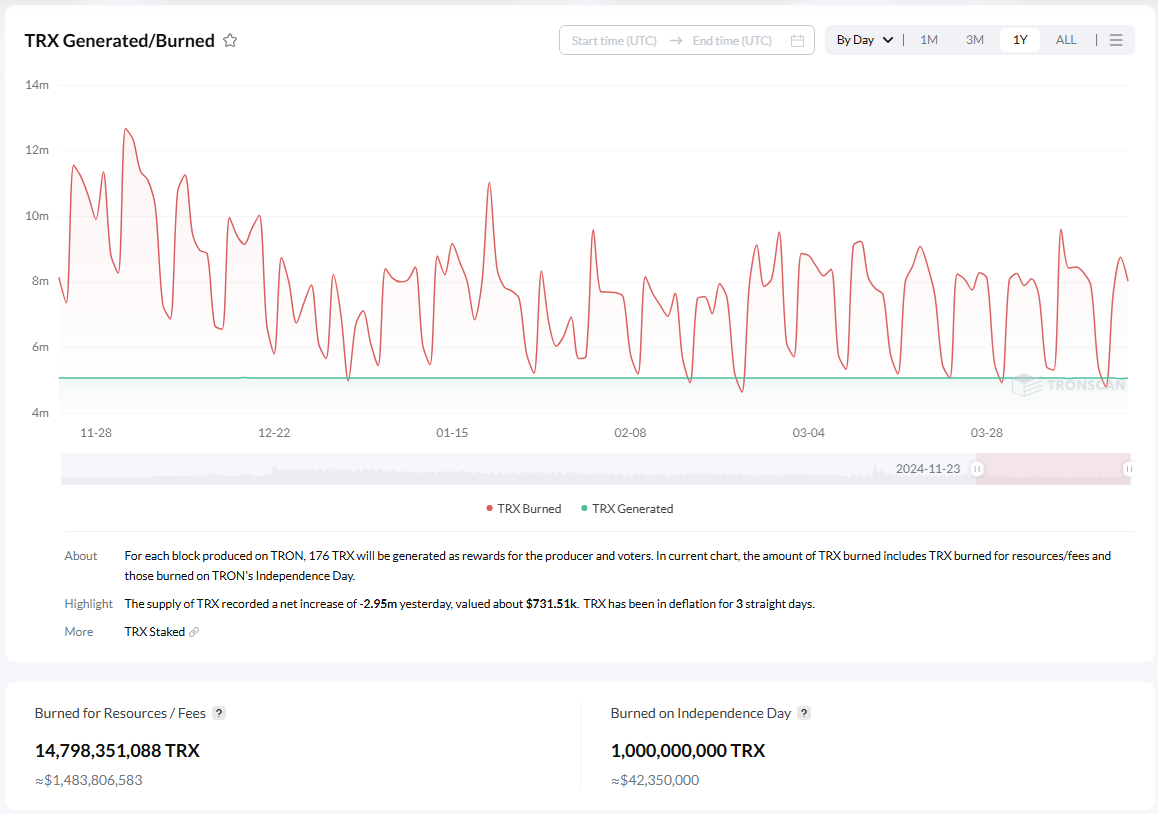

Quite often, users of even such an inexpensive network as Tron are perplexed that they do not have enough funds to pay for gas, although yesterday the same transaction cost much less. This is because the user conducted transactions under different network conditions.

During periods of high network load, fees can increase significantly. In the Tron ecosystem, this can lead to excessive burning of expensive native TRX crypto instead of Energy resource obtained through staking or renting.

For example, on the Ethereum blockchain, fees can range from a few dollars to hundreds of dollars per transaction depending on network congestion.

You should also be aware of the conditions for some operations. For example, if you transfer USDT on the Tron network to a wallet that does not have these stablecoins, the transaction will cost you twice as much as a transfer to a wallet where USDT is present.

The size of the commission is directly proportional to the complexity of the transaction. For example, a simple TRX transfer on the Tron network is ~$0.25, while a TRC-20 standard token transfer is ~$3.09.

Conversion Fees

Exchanging one cryptocurrency for another may be accompanied by hidden fees, especially on platforms with non-transparent pricing policies.

Additional fees are quite common when depositing or withdrawing funds if the account is replenished in one currency and trading is done in another. Under these conditions, the exchange may apply an additional fee, which is often not disclosed to traders.

Withdrawal Fees

This is a fee for withdrawing funds from an exchange to an external personal wallet or bank account. When withdrawing cryptocurrency, the fee is usually fixed, while when withdrawing fiat funds, it depends on the payment method (e.g., up to 5% for a bank transfer or PayPal).

Some platforms charge significant fees for withdrawing cryptocurrency to external wallets. So, before making a transaction, clarify the withdrawal fee from your crypto wallet with the exchange's support service.

Factors Affecting Fee Size

Several factors mentioned above determine the size of commissions for transactions on the Tron and Ethereum networks. However, most factors affect the fee size on most cryptocurrency blockchains, and consequently, on related decentralized services and platforms.

What Determines the Size of Commissions

- Network Congestion. On most cryptocurrency blockchains, during periods of high user activity, transaction fees can increase significantly. This is especially true for mining blockchains, as it is in the miners' interest to choose the most profitable transactions for them. For example, on the Ethereum network, during moments of increased user activity, the cost of operations can rise to enormous values.

- Transaction Size. Larger or more complex transactions may require a larger commission for their processing. Above, we compared the commissions for a simple transfer of native crypto and a transfer of stablecoins, i.e., an operation involving a smart contract call. And if a user interacts with a package of smart contracts, the commissions will be higher due to the increased transaction size.

- Type of Platform Used. Different exchanges and wallets have their own fee structures, which can vary significantly. For example, fees on different exchanges can range from 0.5% to 4.5% of the transaction amount. It also matters whether the exchange uses methods to reduce transaction costs depending on the features of the cryptocurrency blockchain. For example, the Tron ecosystem allows paying for gas not only in native TRX crypto but also using special resources for this purpose, one of which, Energy, can be rented on special services.

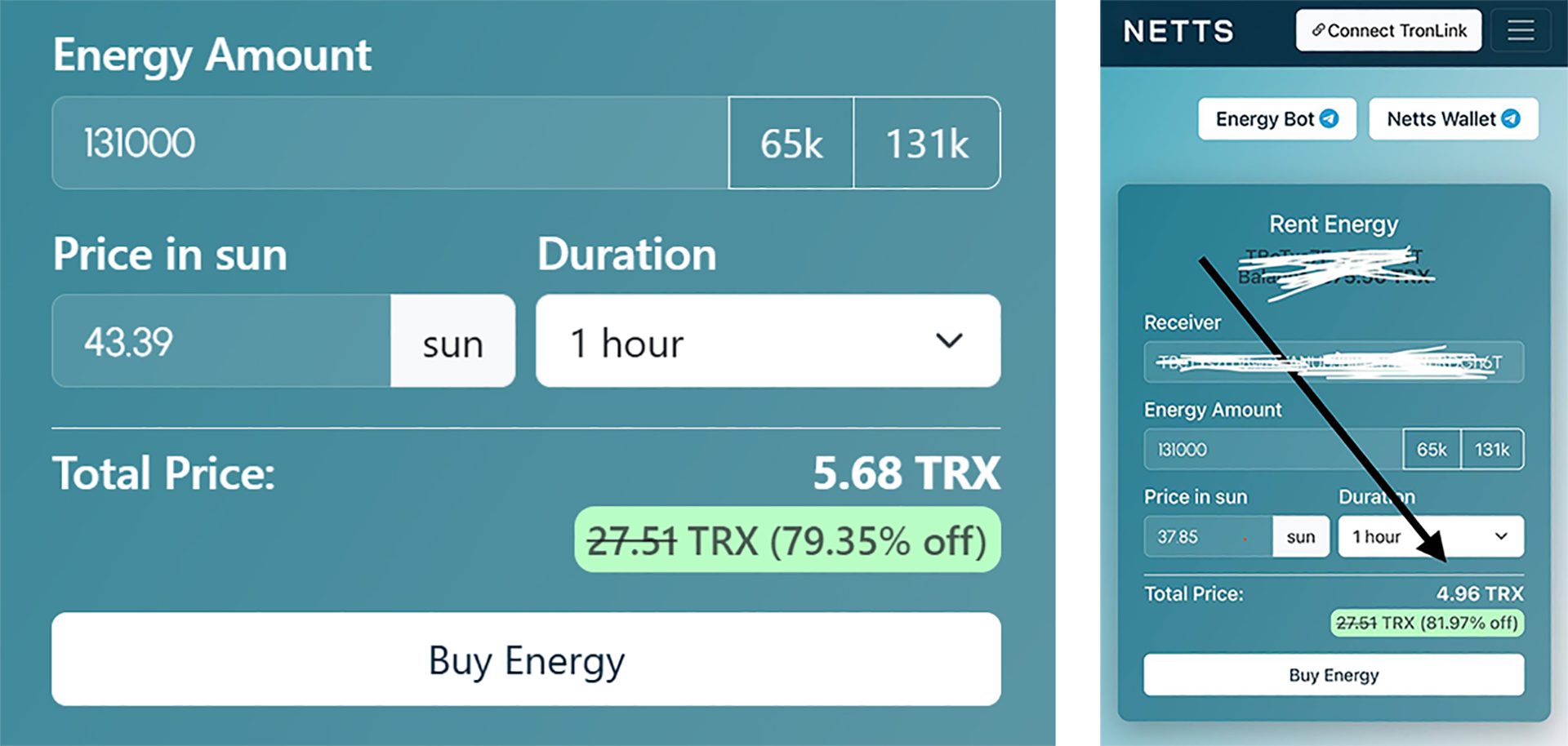

The NETTS Energy rental service is built on the Tron blockchain and provides users, including exchanges, exchangers, P2P platforms, and other decentralized platforms, with the opportunity to significantly reduce transaction costs, for example, when transferring USDT TRC-20. As you know, today this is one of the most demanded stablecoins pegged to the US dollar exchange rate.

Minimizing commissions is achieved by excluding TRX from gas payments. Instead, NETTS provides the special Energy resource for rent, which is used to pay commissions for USDT TRC-20 transfers.

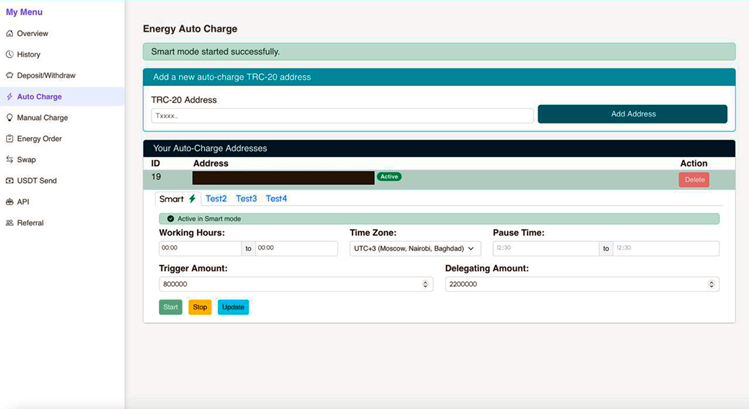

At the same time, NETTS, by connecting the exchange to the API, provides any necessary amount of Energy for transfers. Energy can be supplied according to a schedule provided by the client of the Energy rental service (exchange, etc.), or based on a trigger. The client specifies the Energy level on the balance, upon reaching which the wallet is replenished with the resource. And in Host mode, a variant of constant Energy replenishment is possible – "eternal" Energy.

The NETTS Energy rental service provides savings on transactions of up to 80%, and during periods of minimal Tron network load – almost 82%, as shown in the screenshots below.

At the same time, the NETTS service does not charge any hidden fees – you deposit 15 or 1 TRX, depending on the choice of automation type. The first option is entry through a Telegram bot. The second is through the Workspace web interface with the possibility of connecting via API.

The option of applying for Energy rental through the website form involves prepayment. It is more suitable for individual users who make 1-2 transfers per day.

The Telegram bot and Workspace are preferred by large cryptocurrency business platforms that transfer USDT TRC-20 to dozens of addresses daily.

Clients of the NETTS Energy rental service connected via API, during periods of minimal Tron network load, will only have payment deducted from their deposit for the Energy actually used out of the entire rented volume. As you can see – everything is truly transparent.

With NETTS, you are not afraid of any hidden exchange fees, as well as an increase in gas fees during periods of high Tron load.

Right now, go to the NETTS Energy rental service, deposit 1 TRX into Workspace, and test the API capabilities. From this moment on, pay for transactions in Tron with rented Energy and keep 80% of your TRX.

Ways to Minimize Hidden Fees

Now you know what surprises and under what circumstances you may encounter when interacting with cryptocurrency platforms. We hope that after reading this information, the number of hidden fees for you will decrease. The main thing is to carefully study all network and exchange fees before interacting with cryptocurrency platforms and systems.

And if you follow these recommendations, you will be able to reduce transaction costs. To achieve this, it is enough to perform a few simple actions.

- Make transfers during periods of low network congestion to reduce fees. Choosing the optimal time for transactions can significantly reduce network fees.

- Choose a blockchain that offers lower fees for the operation you are interested in. Compare: the average transaction fee on the Tron network is less than $0.01, while on the Ethereum network, fees can range from a few dollars to hundreds per transaction.

- Before making a transaction, study the exchange fees of various platforms, as well as wallets, which will help you choose the most favorable conditions. Transaction fees on various exchanges can range from 0.5% to 4.5%.

- Use payment gateways (bridges) with minimal fees and the ability to work with a large number of digital currencies and other assets. Payment gateways usually offer much lower fees for processing crypto payments than exchanges and provide the ability to customize interfaces via API.

Conclusion

Fees that the user is unaware of can significantly affect the efficiency of using cryptocurrencies.

Many call such fees hidden, but in reality, awareness and a proactive approach will help minimize transaction costs when working with decentralized networks, exchanges, and services.

You should analyze the policy of a decentralized platform, carefully choose platforms and tools for working with cryptocurrencies. Then all fees and charges will be transparent for you, and transactions will be as economical as possible.