Is It Worth Staking TRX or Is It More Profitable to Rent Energy? Comparison of Two Methods: Staking vs Renting Energy

How to reduce transaction fees? As the Tron blockchain continues to gain momentum, this question is becoming relevant not only for individual users, but also for organizations. Especially if stablecoins that support the US dollar exchange rate, USDT TRC-20, are used to transfer funds – these are smart contracts, like all Tron tokens of the TRC-20 standard.

The two main methods of securing the necessary resources to process transactions on the TRON network are Energy leasing and staking TRX, the native cryptocurrency of the Tron blockchain. Let's look at a set of advantages and disadvantages of each method, which will help you make a choice depending on your specific needs, capabilities, and the volume of planned transactions.

Before we dive into the comparison, it is important to understand what the Energy resource is in the Tron network, and why it is important to have enough of it if a blockchain user is interacting with smart contracts.

Energy is a resource in the Tron system used to execute smart contracts, in particular for transactions of TRC-20 tokens, such as USDT TRC-20 stablecoins – one of the most popular variants of the Tether token, which is pegged to the US dollar exchange rate.

Without enough Energy, users must burn TRX to process transactions – a very inefficient way to spend native crypto. Earning Energy through staking or renting is an opportunity to significantly reduce these costs. Which of these methods is more profitable for you?

What is TRX Staking?

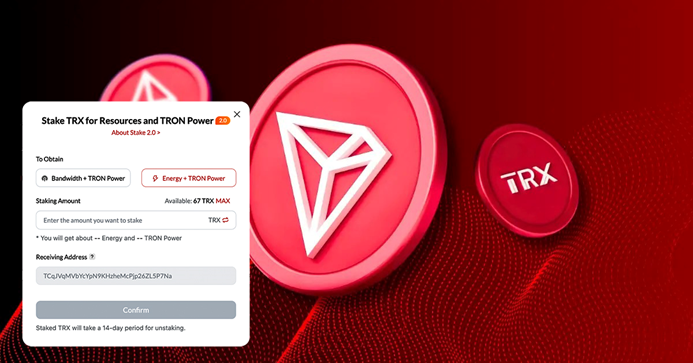

Staking TRX involves locking a certain amount of the native cryptocurrency of the Tron blockchain to generate Energy. The amount of the resource you receive is directly proportional to the amount of TRX you put into “freezing.” Energy received as a reward for transferring TRX for temporary use to the Tron network can then be used as fuel for smart contracts, as this resource is often called. There is no need to burn TRX to pay transaction fees if there is enough Energy in the wallet.

Benefits of TRX Staking

Any amount of TRX can be staked, and if it is large enough, the user receives the following benefits:

- passive income in the form of interest from staked TRX if freezing for at least 1 year;

- accrual of Energy, necessary for conducting transactions without commissions.

Disadvantages of TRX Staking

But not all Tron users can receive the required amount of Energy as a result of freezing – and this is the disadvantage of this method.

- A significant amount of TRX must be frozen to obtain enough Energy to fully pay for transactions. For example, to have enough Energy for a single transfer of the USDT TRC-20 stablecoin, about 12,000 TRX must be frozen at the time of writing.

- Limited liquidity of funds during the staking period. You cannot interrupt the process and release your assets if you suddenly need them urgently. Although you will receive Energy immediately, you will not be able to release TRX from staking until 14 days have passed (the term is valid at the time of writing).

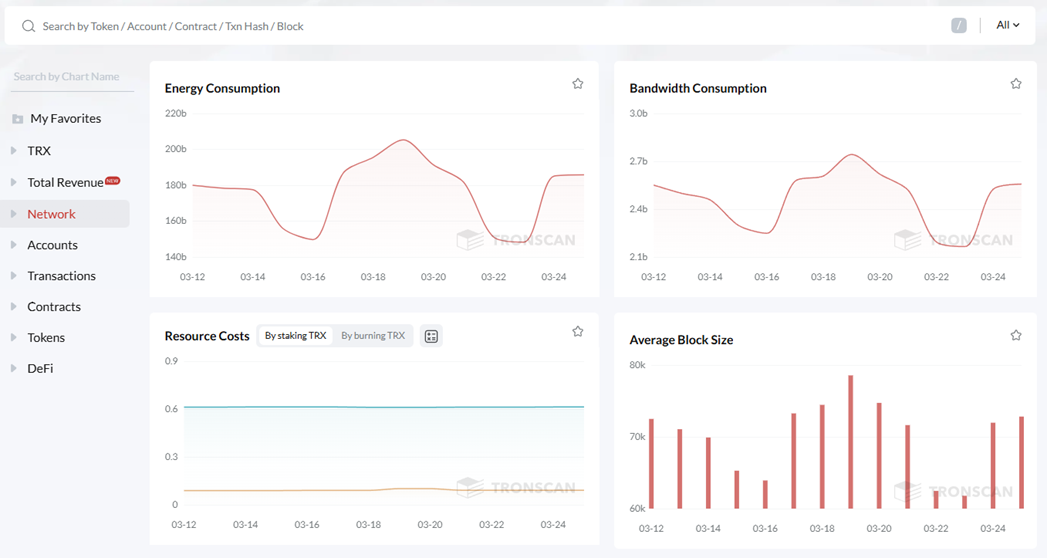

The Tron ecosystem platform is a dynamic model and responds to changes in the network in real time. For example, the amount of TRX to freeze can fluctuate depending on the overall distribution of staking in the network.

If the system is overloaded, it will increase the commission fee on the fly, and the available Energy volume (as well as the Bandwidth resource, by the way) may not be enough for the transaction that has already been launched. As a result, Tron will either make up for the missing resource volume at the expense of TRX, or the transaction will hang altogether if there are no native crypto reserves in the wallet.

In this case, it is impossible to top up your wallet balance using staking. Unless, of course, you know about such an effective and profitable method as renting Energy.

What is Energy Renting?

This is an alternative to staking – you can rent Energy from other users or Energy rental services in the TRON system.

Such method has more advantages than disadvantages.

Benefits of Renting Energy

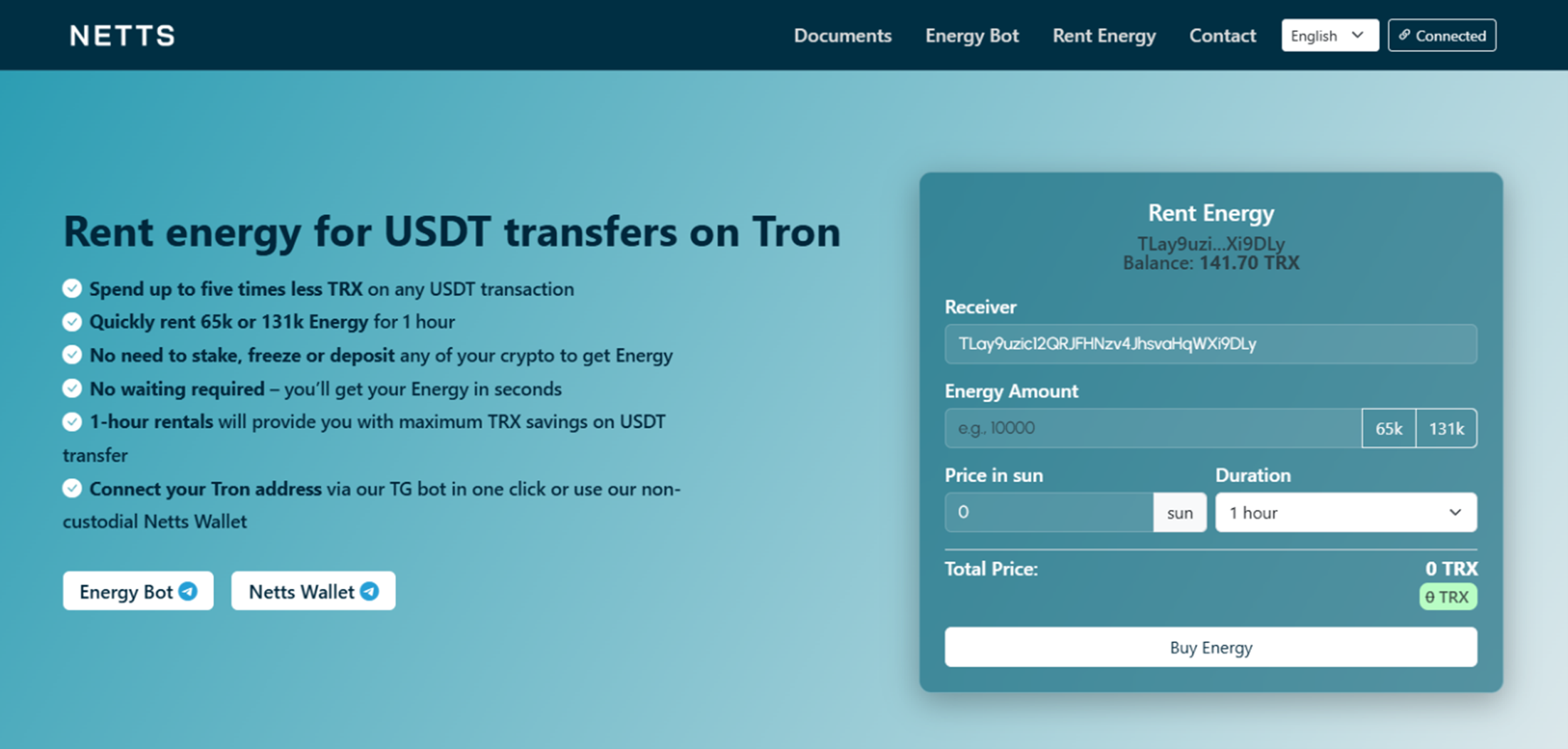

The most important advantage of renting Energy is that you do not need to have a large volume of TRX, and there is no need to resort to staking, making your native crypto tokens unavailable to you for half a month. In addition, renting Energy provides the user with:

- Flexibility in choosing the volume and duration of Energy rental. This is especially attractive to users who deal with smart contracts with fluctuating transaction volumes. You can rent as much resource as you need without committing to long-term staking.

- The ability to reduce commission costs to zero, you only pay the service for rent. This is several times less than the cost of the staked Energy that you typically spend per transaction.

- Eliminate the risk of Energy shortage when changing the size of the commission. Energy rental is immediate access to the resource.

- No long-term commitments between the user and the rental service.

- There is no asset lock-up: your funds remain liquid and available for other investments or use.

Among the disadvantages one can name only the absence of additional rewards that are possible with staking, such as participation in blockchain management.

Comparison of Staking and Energy Rental

For clarity, let's look at individual aspects of Energy staking vs renting and evaluate the leader in each of these methods.

Financial Costs

- Staking – the requirement for a significant initial investment to freeze TRX.

- Energy renting – Get three times more transactions for the same investment.

Flexibility

- Staking – restriction for a certain period of user access to TRX sent to staking.

- Energy renting – you are given maximum flexibility in managing not only resources: the user sets the rental time and term, as well as the amount of Energy that the service must provide.

Efficiency

- Staking – it is impossible to get Energy instantly, for example, if there are not enough funds during the transaction and it freezes.

- Energy renting – instant access to the resource, charging the user’s wallet with the required amount of Energy within a couple of seconds.

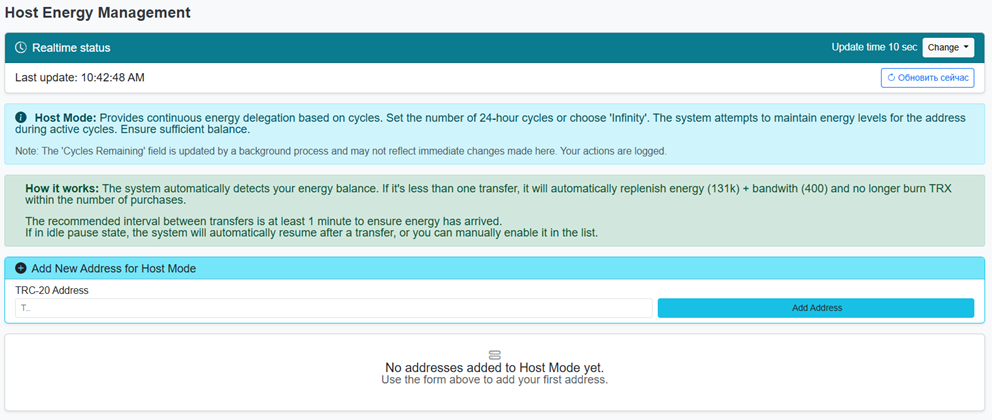

If you use our Workspace API you can specify the cycles of automatic refilling, trigger amount for refills, and many other parameters to come up with perfect individual settings for any USDT transfers you might need. Only 1 TRX minimum deposit!

Profitability

- Staking provides passive income from network rewards.

- Renting energy does not generate additional income, but it does reduce commissions.

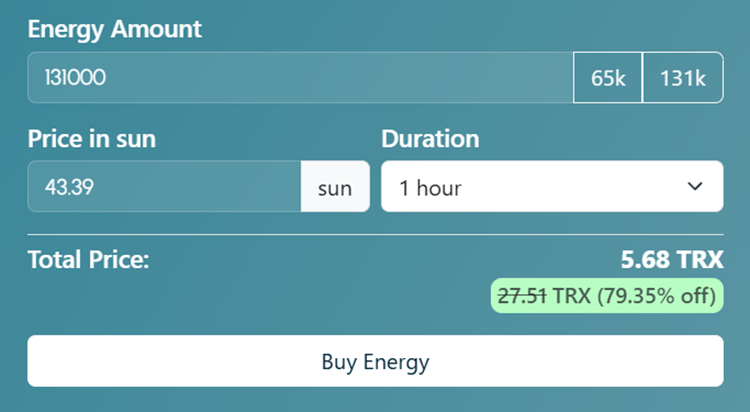

For example, the Energy service NETTS provides its clients with up to 80% cost savings compared to staking. Here's a look at how much it would cost you to rent 131,000 Energy units on this service. Let us remind you that this is the equivalent of 27 TRX – this is how much you would have to spend when transferring USDT TRC-20 to a wallet that does not have these tokens or for a couple of transfers of this stablecoin if the recipient already has the same on their balance.

In conclusion, we note that the choice of method for obtaining the required Energy depends on the financial capabilities and activity of the user when interacting with smart contracts, that is, on the frequency of transactions.

The choice is simple: if you are not ready to send large volumes of TRX for staking, you need a reliable and profitable rental service Energy.

With Energy NETTS rental service, you don't even need a large stock of TRX. Experience the benefits of NETTS yourself with a test rental.